Headlines

- US corn harvest continues to lag now 21% behind 5-yr avg. Interior basis still strengthening (up 20c in a week in Decatur)

- Soybeans near 5-yr avg pace (caught up). Interior basis now flattened out

- US Commerce department has set duties on Argentinian biodiesel between 54.4 and 70.1% as well as Indonesian origin biodiesel at 50.7%

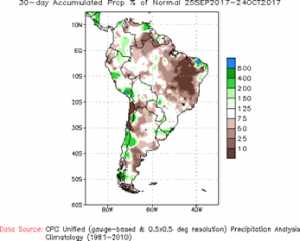

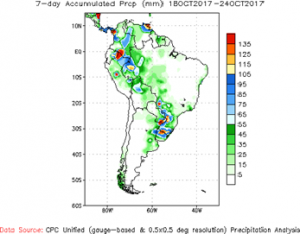

- Brazil 20% planted vs 29% LY and 19% avg. Mato Grosso 27% vs 47% LY. Expecting some replant due to dryness

- Brazil corn planting slightly ahead of pace

- Chinese Customs – imported 627,518 tons of corn in Aug/Sep. USDA using 3MMT for 2017/18

- China changing domestic grain price supports. I take it as they are unable or unwilling to subsidize the domestic market while players import cheaper, higher quality foreign grain. Could be bearish.

- 7MMT of 2013 and 2014 vintage Chinese corn was up for auction on Thursday and Friday.

- Chinese September soybean imports up 12.7% over Sep 2016

- Ethiopia is looking for 400k tons of milling wheat for Feb 2018

- Brazil is looking for over 700k tons of wheat (normal net exporter – supportive)

- South Africa corn plantings expected 6% lower than 2016/17 due to large harvest (supportive?)

- IGC raised the 2017/18 world corn and wheat production to 748.5mmt (+.9mmt) and 1034mmt (+5.2mmt)

- China sets 2018 import quotas – Corn 7.2 MMT; Wheat 9.64 MMT

Exports

Shipments of corn and spring wheat continued to be poor for the second week in a row while soybean shipments were the largest of the marketing year at 94.15 million bushels. I read somewhere that 73 percent of the shipments to China in September were of Brazilian origin with the remainder being split mostly between the US (11%) and Argentina (9%). The US is still very competitive with soybeans into China for the Nov/Dec slot. Sales this week were excellent for all three commodities. Total corn sales came in at 50.72 million bushels (2nd largest of MY) or about double necessary rate. Bean sales were good for 78.2 million bushels and should continue strong for the foreseeable future based on current world values. Spring wheat sales came in at a respectable 5.39 million bushels (Japan, Philippines, Panama) after a whopper of a week last week at 9.2mb. Just 3.27 million bushels in sales are needed weekly going forward for spring wheat. I don’t know that spring wheat export strength is strong enough for USDA to make an adjustment to the November WASDE, however, if this can continue into November than I would predict a revision higher in the December edition. We are now 20 weeks into the marketing year and the weekly sales rate on an annualized basis has averaged 234.6 million bushels with approximately 64 million bushels in carry-in sales for this year. At a total of 298.6 million versus the USDA estimate of 260 million there is some room for marginal error.

Domestic Demand

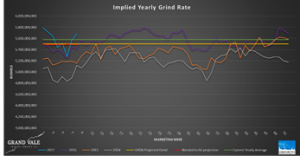

Ethanol production was raised 20kbpd to 1040k for the past week amounting to a grind at of 109.2M bushels of corn ground at 2.8 gallons per bushel implying a yearly grind rate of 5.678 billion bushels compared to the 5.5 billion bushels of demand for ethanol production indicated by USDA.

South America Precipitation (7-day precip & 30-day % of normal precip)

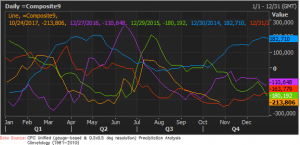

Commitment of Traders

Corn

Soybeans

CBOT WHEAT

Technicals

November Soy

The November soybean contract is interesting. Still trading confidently within the upward channel that began with a doji in min August, the November soybean contract traded down to the 38.2 percent retracement from the July high to the August low. The stochastic indicator on the daily indicates an oversold condition, which would have us looking for a bounce this week from the 38.2 percent retracement and channel low to target somewhere between 1000 to 1020. The weekly shows a similar form of trade, albeit a lower low than last week, except that the same stochastic indicator has just finally brought soybeans down from overbought. Do we get a bounce in beans? I think so as long as exports remain strong and the farmer is reluctant to sell any more. Cash remains weak, but history has shown that the USDA historically under-predicts demand growth, which probably keeps the funds hungry.

December 17 Corn

Corn managed to remain supported with a short covering bump last week. The bounce was good enough for a fake breakout higher, but was faded abruptly as nobody that I’m aware of is concerned we’re going to run out of corn in the foreseeable future. However, with the end user hand to mouth and the funds near a record short I believe we are now at a point where it is dangerous for a spec short to be entering additional short positions given the risk reward. IF something serious begins to develop in SAM the fund short will likely get very nervous and begin to cover, which I believe is what we saw momentarily last week. Keep an eye on this as I consider a rally like this to be a pricing opportunity, not an opportunity to try and establish additional long positions.

Spring Wheat

Spring wheat maintained its 605-support level last week, but once again struggled to get any traction above 620. The funds have lost interest in spring wheat for the moment to trace returns elsewhere in my opinion. If we want to try and sell some calls against physical bushels for March it’s great that volatility still remains decent in HRS because it’s very low for corn and beans. If we want to have an opportunity to establish longs again next summer by using calls for a defined risk/reward next summer things being quiet will help. For the time being it’s a dead market, but good things are happening on the export side and the mills are hungry.