Fairly busy day in the grain trade. Grains traded higher overnight into a mixed early morning session with corn, beans and wheat ramping after the noon bell. Do we may find out something about US/China negotiations that led to the ramp around 12:05pm? Informa came out with their idea of PP acres or the lack thereof by increasing corn, soybean, and cotton acres and only reducing HRS acres by 200k. NOPA reported record April crush, which was friendly beans but with the higher trade time didn’t coincide with release of the news; anticipated.

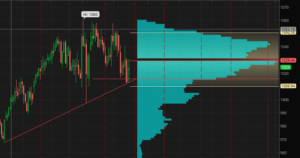

Nov 18 beans price action continues to be interesting. Today it held the trendline (again) and traded up to the point of control where the majority of volume has traded over the past year. You can see by the chart on the right that when it nears the point of control it has been losing all buying interest lately. Something to keep a very close eye on.

| 2018/19 Planted Acreage Estimates | Informa | USDA Current |

| Corn | 89 | 88 |

| Soybeans | 89.4 | 89 |

| Spring Wheat | 12.4 | 12.6 |

| Cotton | 14.0 | 13.5 |

NOPA came out with their soybean crush number for April and announced 161.016 million bushels of soybeans were crushed, a new record for April but down from 171.858 million bushels last month. Strong processor margins enticed plants to run hard. Soy oil stocks rose to a five-year high of 2.092 billion pounds. Meal exports were estimated at 946,291 tons.

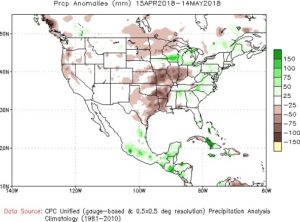

Weather Update

Larger accumulations are expected to remain more in the western corn belt over the next week although lighter amounts are expected across the east as well as a large system unloads over the eastern seaboard. Week 2 GFS suggests that southern MN, northern IA, and southern/central WI will see heavy rainfall totals while a swath from OK to central IL remains drier as do the Dakotas. Below are two images; one is an image depicting rainfall anomalies as a measured amount relative to normal (left) and the other is the two-week evaporative index which shows the stress of evap on moisture supplies. This is a major reason that accompanies the S&D tightening that is cause for concern. Meanwhile in South America we continue to see heavy rainfall totals over Paraguay with some in southern Brazil. Lately, southern Brazilian rains have disappointed. Argentina, particularly around Cordoba and Buenos Aires, will see a bit of a break while next week a small portion west of Uruguay sees rain.

Daily Reported Sales – business days since an announcement: 11

| Date Announced | Buyer | Commodity | Amount | Marketing Year |

| 4/30/2018 | Argentina | Soybeans | 120k | 2018/19 |

| 4/26/2018 | Unknown | Corn | 107.6k | 2017/18 |

| 4/24/2018 | Argentina | Soybeans | 60k | 2017/18 |

| 4/24/2018 | Argentina | Soybeans | 70k | 2018/19 |

| 4/11/2018 | Mexico | Soybeans | 141.518k | 2018/19 |

| 4/11/2018 | Argentina | Soybeans | 120k | 2018/19 |

Currency

The dollar continues to be strong amongst near promises of rate hikes as the economy soldiers on. Meanwhile the Peso put in what could be a double bottom with the first bottom in place back in Jan and possibly this week? The Brazilian Real continues to get crushed with 1 USD now equal to 3.6640 BRL’s.